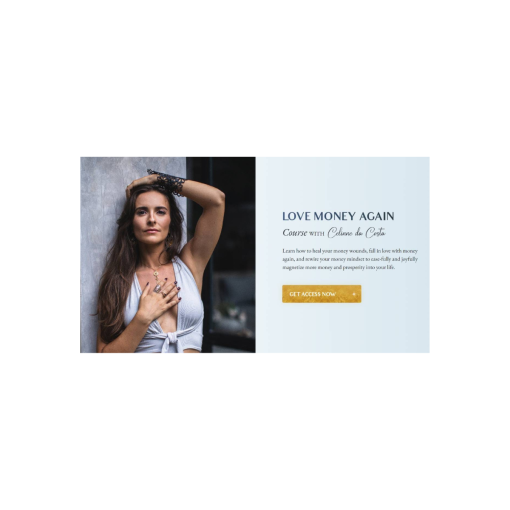

Ever felt like your relationship with money could use a serious makeover? That’s where Celinne Da Costa steps in. As a master of transformation, she’s the go-to guru for reshaping your financial mindset.

I’ve delved deep into her strategies and I’m here to share how “Love Money Again” isn’t just a catchy phrase—it’s a life-changing philosophy. Celinne’s approach isn’t about quick fixes; it’s about sustainable wealth and inner prosperity.

Celinne Da Costa hasn’t always been the heralded money mindset coach she’s known as today. Her journey began like many of us, caught in the hustle of a conventional 9-to-5 job, feeling unsatisfied and disconnected from her true potential. It’s through this initial discomfort that Celinne’s passion for personal growth and wealth transformation skyrocketed.

I came across Celinne’s work when seeking ways to revamp my own approach to money. What struck me was her remarkable pivot from a traditional career in corporate America to becoming a highly sought-after thought leader in financial empowerment. Celinne’s transformative coaching has enabled countless individuals to rewrite their financial stories, fostering a new generation that’s attuned to sustainable wealth creation.

But what stands out about Celinne isn’t just her aptitude for financial coaching – it’s her holistic approach. She’s a fervent believer that a healthy relationship with money goes beyond the numbers in one’s bank account; it intertwines with personal self-worth and lifestyle. This philosophy is what drives her to craft strategies that aren’t merely surface-level fixes but rather deeply-rooted changes to one’s financial mindset.

Having collaborated with Celinne, I observed firsthand how her methods are meticulously personalized. She’s not about one-size-fits-all solutions. Instead, she dives into the unique intricacies of each client’s situation. Her programs are designed to navigate through emotional barriers and instill robust, positive financial habits that stand the test of time.

The impact of Celinne’s coaching methods shines through in the success stories of individuals who’ve broken free from financial anxiety to embrace abundance and prosperity. Her approach is a testament to the potential for change that lies within all of us, revealing that the path to loving money again is rooted in a deep personal journey, intertwined with the right guidance and mindset shifts.

Money’s influence on happiness has long been a topic of debate. Experts like Celinne Da Costa weigh in on this complex relationship, asserting that emotional well-being and financial health are intricately linked. It’s not simply about earning more but nurturing a positive relationship with money.

In my interactions with countless individuals seeking financial wisdom, I’ve noticed that happiness stems from feeling in control of one’s finances. People who find joy in their wealth usually:

These habits don’t require immense wealth; instead, they reflect a mindset of abundance that promotes contentment.

The pursuit of happiness through money alone can be illusory. It’s the meaningful experiences and sense of security that money facilitates which contribute to genuine satisfaction. The feeling of being able to support loved ones or invest in personal growth can significantly boost one’s happiness quotient.

On the flip side, those who equate their self-worth with their net worth often find themselves in a state of perpetual discontent. This is where Celinne’s approach proves invaluable. By integrating self-worth and financial strategies, she helps clients redefine success on their own terms.

In my quest to understand the dynamics of money and happiness, I’ve discerned that key factors include:

Addressing these areas can transform one’s financial journey from a source of stress to a foundation for fulfillment. So, while the balance sheet is crucial, it’s the psychological relationship with our finances that ultimately shapes our well-being.

Much of this philosophy is echoed in Celinne’s work, as she steers individuals toward uncovering the emotional layers behind their financial decisions. By guiding people to love money again, she’s not just altering bank balances but enhancing overall life satisfaction.

I’ve realized that understanding your money mindset is fundamental to managing financial stress and achieving happiness. Money mindset is the unique beliefs and attitudes we hold toward money, which shape our financial decisions and ultimately, our sense of well-being. Celinne Da Costa suggests that it’s crucial to dig deep into our emotional connection with money to truly transform our financial journey.

Discovering the roots of your money thoughts isn’t just enlightening; it’s liberating. It begins with a self-assessment to identify the feelings that money triggers in you. Do you feel anxious, empowered, or indifferent when you think about your finances? Your emotional response to money is telling; it’s influenced by family upbringing, societal messages, and personal experiences.

It’s also important to differentiate between a scarcity mindset and an abundance mindset. If you find yourself constantly worrying about not having enough, you may be trapped in a scarcity mindset. This perspective can lead to self-limiting behaviors and missed opportunities. On the flip side, an abundance mindset opens you up to possibilities, encouraging a healthier relationship with your finances.

I’ve learned that getting to grips with your money mindset requires a blend of self-reflection and practical action. Here are some steps to help you along the way:

These habits don’t just help in managing money; they contribute to a more content and grateful life. I encourage you to explore your money mindset and recognize how it influences your life. Remember, tweaking your mindset could be the key to not just loving money again but also crafting a life that’s rich in happiness.

Embarking on a journey to reshape your financial future requires more than just recognizing your money mindset. It’s also about realigning your financial goals to match your true aspirations. When I sat down to reconsider my own goals, I discovered that tangible targets coupled with clear action plans propelled me forward more effectively.

The process starts with identifying what truly motivates you. Whether it’s achieving financial independence, providing for your family, or traveling the world, understanding your ‘why’ can tremendously steer your financial planning. For me, it was the desire to craft a lifestyle that allowed for both personal growth and financial security.

Next, I found it beneficial to ensure my goals were SMART: Specific, Measurable, Achievable, Relevant, and Time-bound. By outlining my goals with these criteria in mind, I set up a framework that felt both ambitious and attainable. Here’s an example of how my financial goal evolved into a SMART one:

Once your goals are set, create a roadmap. Break down your objectives into smaller, manageable tasks. It’s like constructing a house, where the foundation needs to be laid down before you can build the walls and roof. My approach involved setting monthly targets and assessing progress regularly, which kept me accountable and adjusted my course as needed.

Lastly, intertwine your financial plans with your life values. Money, after all, is merely a tool that enables us to live according to our beliefs and passions. For instance, if family is a core value, your financial choices should uphold and enhance familial relationships and wellbeing.

With these steps, realigning your financial goals becomes an impactful part of your journey to money mastery. By doing so, you don’t just work towards wealth, you steer your finances in a direction that complements your unique vision of happiness and fulfillment.

When I began exploring Celinne Da Costa’s approach to finances, I discovered actionable methods for transforming my relationship with money. Her strategies revolve around mindset shifts and practical exercises that instill a sense of empowerment when it comes to managing finances. I’ll share some of these strategies I’ve successfully implemented in my own financial journey.

First off, self-reflection played a pivotal role. By examining my past financial decisions through guided prompts, I pinpointed underlying emotions driving my spending patterns. This type of deep introspection can be quite revealing, as it often unearths hidden motivations behind our financial choices. Da Costa’s methods encourage a blend of introspection and mindfulness which helps in making more conscious financial decisions.

Visualization is another technique I employed. Imagining a future where my financial goals are achieved not only boosted my motivation but also served as a guiding light for my decision-making process. Da Costa advocates for this practice, as it clearly defines the ‘why’ behind our financial pursuits, tethering them to our larger life aspirations.

Moreover, I’ve learned to set SMART goals specific to my financial aspirations. For instance, a goal like “save $10,000 for a down payment on a house by the end of the year” comes with clear markers for my progress which keeps me on track. It’s crucial to break down larger financial objectives into smaller, more manageable tasks which can lead to quick wins and sustain motivation.

One thing I’ve particularly appreciated is the emphasis on tying financial goals to my core values and passions. Aligning my spending with what truly matters to me has created a more fulfilling and intentional approach to money management. Every dollar spent is an extension of my values translated into a tangible action, and this congruency has been life-changing.

Lastly, Da Costa stresses the importance of regular assessments. Life’s unpredictable nature means our financial strategies need to be flexible. I now schedule monthly financial check-ins, adjusting plans as needed to reflect any new priorities or changes in my income scenario.

Embracing Celinne Da Costa’s approach has revolutionized my relationship with money. I’ve learned it’s not just about earning or saving but aligning my financial journey with my deepest values and goals. By setting SMART objectives and breaking them into tangible tasks I’ve found a sense of clarity and purpose in my financial decisions. Regular check-ins keep me on track and allow for the flexibility to pivot when life throws a curveball. I’m more motivated than ever to pursue my passions with financial strategies that reflect who I am and what I value most. It’s empowering to know I’m not just managing my money—I’m crafting a life rich with intention and purpose.

The article centers on the necessity of aligning financial goals with personal aspirations, and emphasizes the creation of SMART goals to achieve a more fulfilling approach to money management.

SMART goals are goals that are Specific, Measurable, Achievable, Relevant, and Time-bound, ensuring they are well-defined and reachable within a reasonable timeline.

The article suggests regularly assessing financial progress to maintain accountability and to make necessary adjustments to stay on track with one’s goals.

Aligning financial plans with life values ensures that every financial decision supports and reflects your personal beliefs and passions, leading to a more satisfying and purpose-driven life.

Celinne Da Costa is a coach and strategist whose methodologies in self-reflection, visualization, and goal setting have aided in the transformation of financial goal alignment discussed in the article.

After your purchase, you’ll receive a delivery email from us with a download link once we’ve verified and processed your order, typically within a few minutes to a few hours. If you have any questions or need assistance, feel free to reach out to us via live chat – we’re here to help!

All the Courses and Books that are available in our store are digital editions and Not Physical, and are delivered by email.

If you are teacher or you need a lot of books and courses that you need for fair price, Yes we can help and we can do bulk orders. and please contact us for that.

We understand the concern many have about the legitimacy of online platforms, especially when they offer courses and books at affordable prices. Here’s why you can trust coursesblock.com:

No There is no limitation to the number or type of devices you can access courses on.